fr44 car insurance virginia

Ad Get cheap FR-44 auto insurance now. The FR44 insurance minimum in Virginia is 25000 for injury to one person.

What S The Difference Between Sr22 Fr44 Insurance Quotes In Minutes

If you dont own a car youll purchase a Non Owner FR44 Virginia policy and your agent endorses the certificate to a non-owner insurance policy.

. Car insurance companies issue the FR44 certificate. Save 500year when you compare. Find Average 2022 Insurance Rates by Car Make and Model.

The cost of FR44 insurance is determined by your states minimum liability requirements. Start your free online quote and save 536. Find The Right Provider for You.

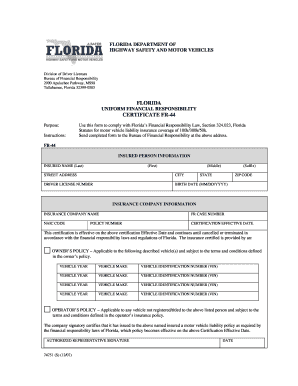

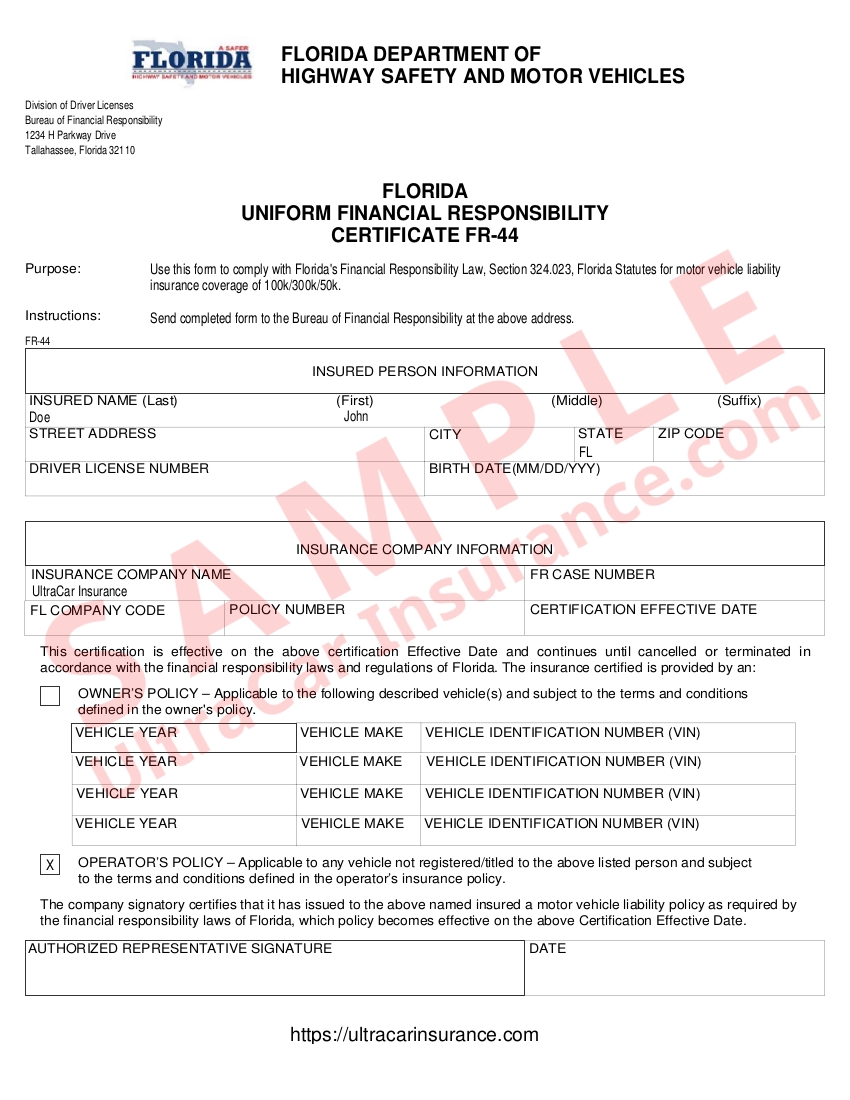

Ad Allstate insurance gives you quality coverage at a great price. If you live in Virginia or Florida and have recently received an infraction for driving under the influence DUI then you may need an FR-44. Also drivers who are required to file an FR-44 must pay for their insurance policy in full.

Get Multiple Quotes Online Fast. Ad Compare Car Insurance Quotes from Top Carriers and Find the Best Rates. The liability insurance requirements for FR44 coverage are 5010040.

Ad Read Reviews and Compare 2022 Top Car Insurance Companies. State Minimum High Risk Low Income. 50000 bodily injury per person.

Start your free online quote and save 536. Also youre required to. Connect to Drivewise and save.

Find Affordable FR-44 Rates. We Are Here to Help. Start your free online quote and save 536.

An FR-44 form is a document of financial responsibility used in Florida and Virginia that proves youve purchased car insurance. If you live in Florida or Virginia then youll. SR-22 coverage in Virginia provides proof of insurance for drivers which is often legally required after a license suspension due to a serious driving violation.

If your license is suspended your state might require you to. You must have auto insurance coverage to obtain an FR44. Ad Get cheap FR-44 auto insurance now.

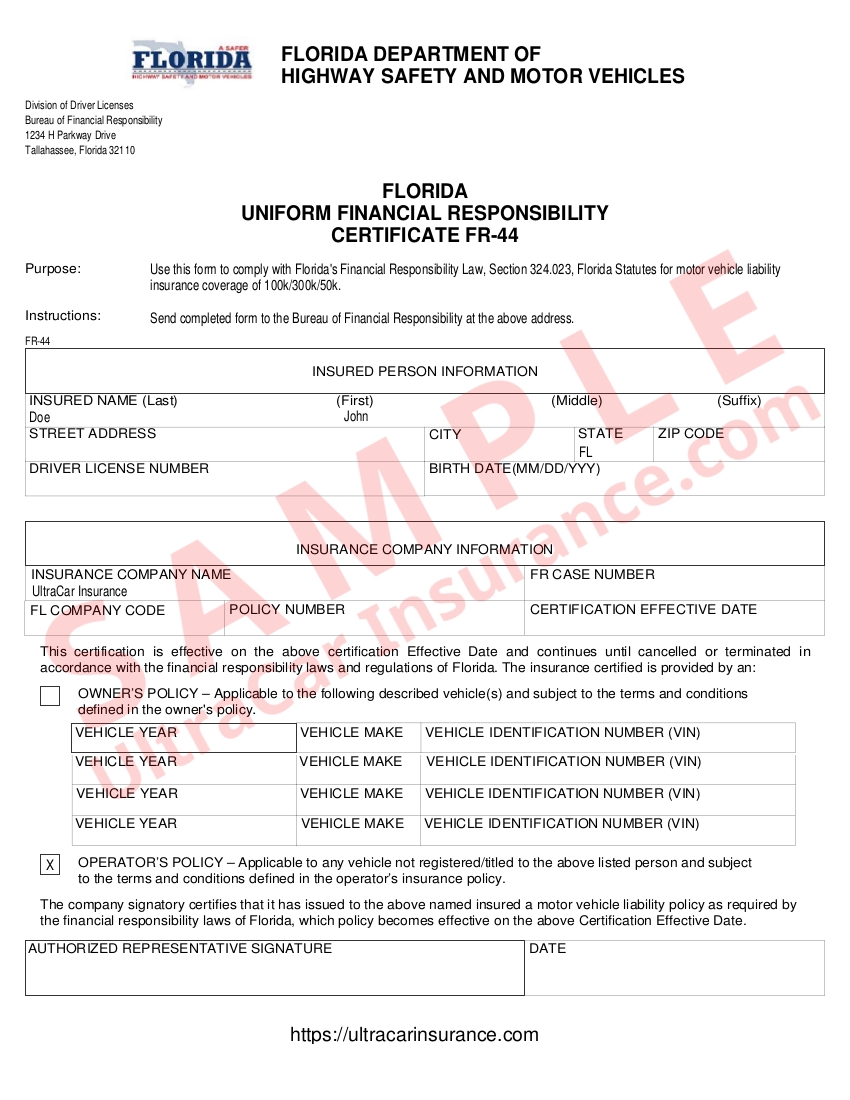

Use this form to comply with Virginia Code 462-316 C for a motor vehicle liability insurance policy with coverage that is double the minimum limits generally required by Virginia. It requires the auto. FR44 insurance requirements in Virginia.

Were Proud To Provide A Secure Place To Compare Car Insurance Quotes. But in Virginia different types of traffic violations can lead to requirement for. 100000 bodily injury per accident.

In the state of Florida filing of auto insurance FR44 certification is required for drivers with DUI or DWI conviction. Ad We have helped over 5 Million Auto-Owners Compare Top Insurance Plans. Find your cheapest car insurance rates.

Review 2022s Top 10 Car Insurance Companies. Weve put together some QAs to help. Ad Get cheap FR-44 auto insurance now.

Try It For Free. Our Comparisons Trusted by Over 45000000. At Allstate safe driving pays.

Virginia SR22-FR44 Insurance Information The state of Virginia uses the SR22 form to help protect its citizens against problem drivers by monitoring their insurance. FR-44 Car Insurance is much more expensive than an SR-22.

What Is An Fr 44 Policy Fr 44 Insurance Coverage Explained

Example Virginia Fr44 Certificate Ultracar Insurance

Fr 44 Vs Sr 22 In Virginia Car Insurance

Fr44 Form Fill Online Printable Fillable Blank Pdffiller

What Is Fr44 Virginia Low Rates On Fr44 Dui Insurance

Example Florida Fr44 Certificate Ultracar Insurance

Best Cheap Sr 22 And Fr 44 Insurance In Virginia Valuepenguin

The Difference Between Sr 22 And Fr 44 Cost U Less Insurance